Market Outlook July 2024

The outlook for the economy as a whole remains subdued for the next couple of years with limited overall growth in GDP forecast.

The latest GDP figures showed an increase of 0.7% in the first quarter of 2024, slightly higher than expected, and bringing the UK out of the short recession experienced at the end of 2023.

However, the growth was driven by the services sector with output falling in the manufacturing and construction sector.

Construction output in 2024 is still expected to fall further with a gradual recovery expected from 2025 onwards, albeit very gradually.

The period of very high inflation (CPI) is now over with the most recent figure of 2.0% in May now in line with the Government’s target, the downward trend is expected to continue more gradually through 2024, with interest rate reductions by the Bank of England expected within the next quarter.

Local Outlook

Looking at Scotland in general, the construction sector is suffering through lower demand, with reductions in enquiries noted across all sectors, but particularly in the public sector due to budget constraints. Finance availability and cost has also been cited as impacting on the private sector, with the impact of any reduction in base rate likely to be gradual.

Contractors’ interest in tendering for projects remains buoyant, however, the M&E market is becoming increasingly challenging with premiums being charged due to supply chain pressures, a lack of skilled resources and the price of specialist plant and equipment.

The following forecasts are based on a middle of the road set of assumptions with regards to trade restrictions and economic performance by the UK economy as a whole. However, the figures could vary by up to 15% (+/-) per annum over the period of the forecast.

Summary of Forecast

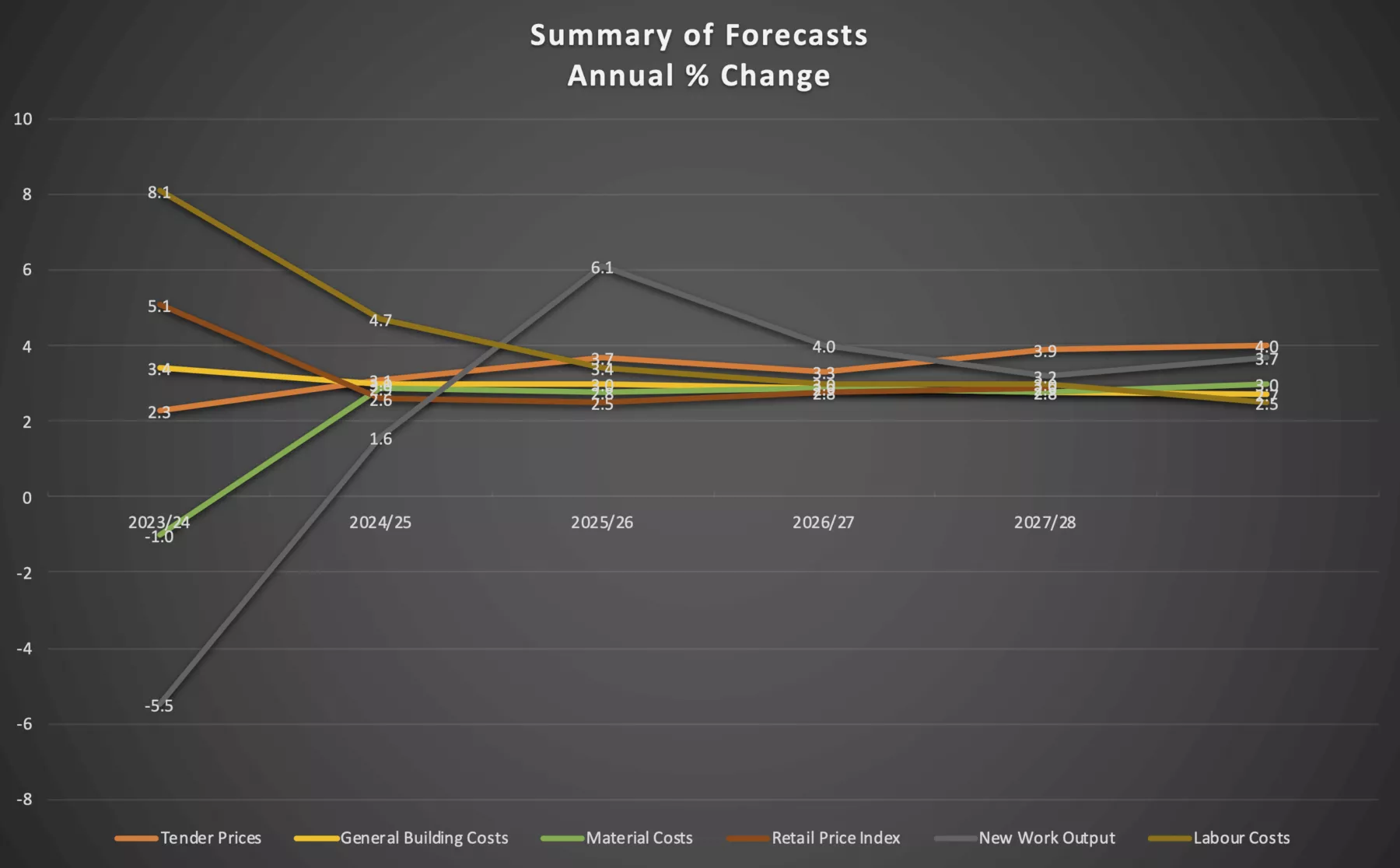

The forecast movements in construction costs currently shown in the BCIS Quarterly Report are as follows:

Overall, UK Tender prices rose by 0.5% over the last quarter, with a rise of 0.6% identified in Scotland. However, the annual rise dropped by a further 0.6% to 2.3% (3.5% in Scotland) when compared with the same quarter in 2023.

Both the UK and Scottish Tender Price Assessment Panels noted an increased willingness to tender. However, contractors are becoming more risk averse, particularly when compared to pre-covid attitudes.

Contactors also seem more selective with simpler, single stage project being more attractive as they aim to maintain a positive cash flow.

The risk of insolvencies remains high, particularly outwith the major cities, resulting in increased tender prices and also in areas where there are large programmes of work in progress.

The forecast for the following five years shows tender price increases of around 2.3% in 2024 and then varying between 3.1% and 4.1% per annum over the rest of the forecast period. The level of competitive pricing currently being experienced is likely to continue into 2025 and it is only from then on, that tender prices will rise faster than costs.

Over the next five years tender prices are currently forecast to rise by 18% overall, a 1% increase compared to the last forecast.

Building costs rose by 0.2% in the last quarter when compared to the previous quarter and by 2.8% from the same quarter a year ago, mainly due to increasing labour and specialist M&E equipment costs, a slight increase from the last forecast but still well below the peak of over 14% seen in mid-2022.

Overall, costs are expected to continue to rise over the next five years, with increases around 3.4% in 2024 and then remaining at around 3% from 2025 for the rest of the current forecast period. Building costs are forecast to rise by 14% in total over the next five years, a reduction of 1% from the previous forecast.

Total new work construction output fell by 2.0% in 2023. A further reduction of around 5.5% is forecast in 2024. Growth of 1.6% is expected in 2025, with increases of 3% - 6% per annum from 2026 to 2029.

Conclusion

Hopes of an improving business outlook are rising, which could provide a boost to the construction sector, with expectations of more favourable investment conditions which could see stalled projects being released onto the market.

Sign up for news

Receive email updates from Thomson Gray direct to your inbox:

- Subscribe to Practice News

- Subscribe to Market Outlook