Market Outlook September 2024

The outlook for the economy as a whole remains muted for the next couple of years with nominal overall growth in GDP forecast.

The growth seen in the first half of the year has slowed with consumers and businesses still dealing with high prices.

Whilst there is now a greater degree of political certainty following the recent General Election, the new Government’s warnings about the state of the public finances are likely to have a significant impact on public sector spending, which will become clearer in the October budget.

In spite of a degree of positivity in the Construction sector, as evidenced by recent UK Construction Purchasing Managers’ Index surveys (a general indicator of construction industry sentiment) being positive for the last six months, output in 2024 is still expected to fall with a gradual recovery expected from 2025 onwards.

The Bank of England’s first interest rate cut since it reached 5.25% in mid-2023 was welcomed across the country, but further cuts may not follow as fast as hoped given the recent small increase in inflation (CPI) to 2.2% in September, slightly above the 2% target, and with further rises to around 2.5% expected by the end of the year. The downward trend is expected to resume in 2025, with interest rate reductions by the Bank of England when deemed appropriate, with one possible cut this year.

Local Outlook

Looking at Scotland in general, the construction sector continues to suffer from lower demand, with anticipated pipelines of projects going to tender over the next 12 months generally remaining unchanged or reducing from the position last quarter.

Contractors’ interest in tendering for projects remains positive, with a preference for a two-stage tender process on larger, more complex projects. However, various trades including cladding, groundworks and M&E are becoming more challenging with supply chain problems remaining.

Public sector funding challenges and planning delays are currently being seen as having an impact on new projects progressing. Overall, anticipated workloads over the next 12 months have either remained constant or have reduced marginally over the last quarter, with the suspension on new healthcare projects still in place.

The BCIS Scottish Tender Price Assessment Panel note in its most recent paper that the market appears to be easing, with contractors now more likely to take on some risk and provide fixed prices for longer durations than recently experienced, although tender prices are rising at a slightly higher rate than the rest of the UK.

There is also more evidence of tender price variations between the central belt and the more remote regions of the country, with the Highlands & Islands showing higher rates of price increases, reflecting the levels of labour demand and additional transport and accommodation costs.

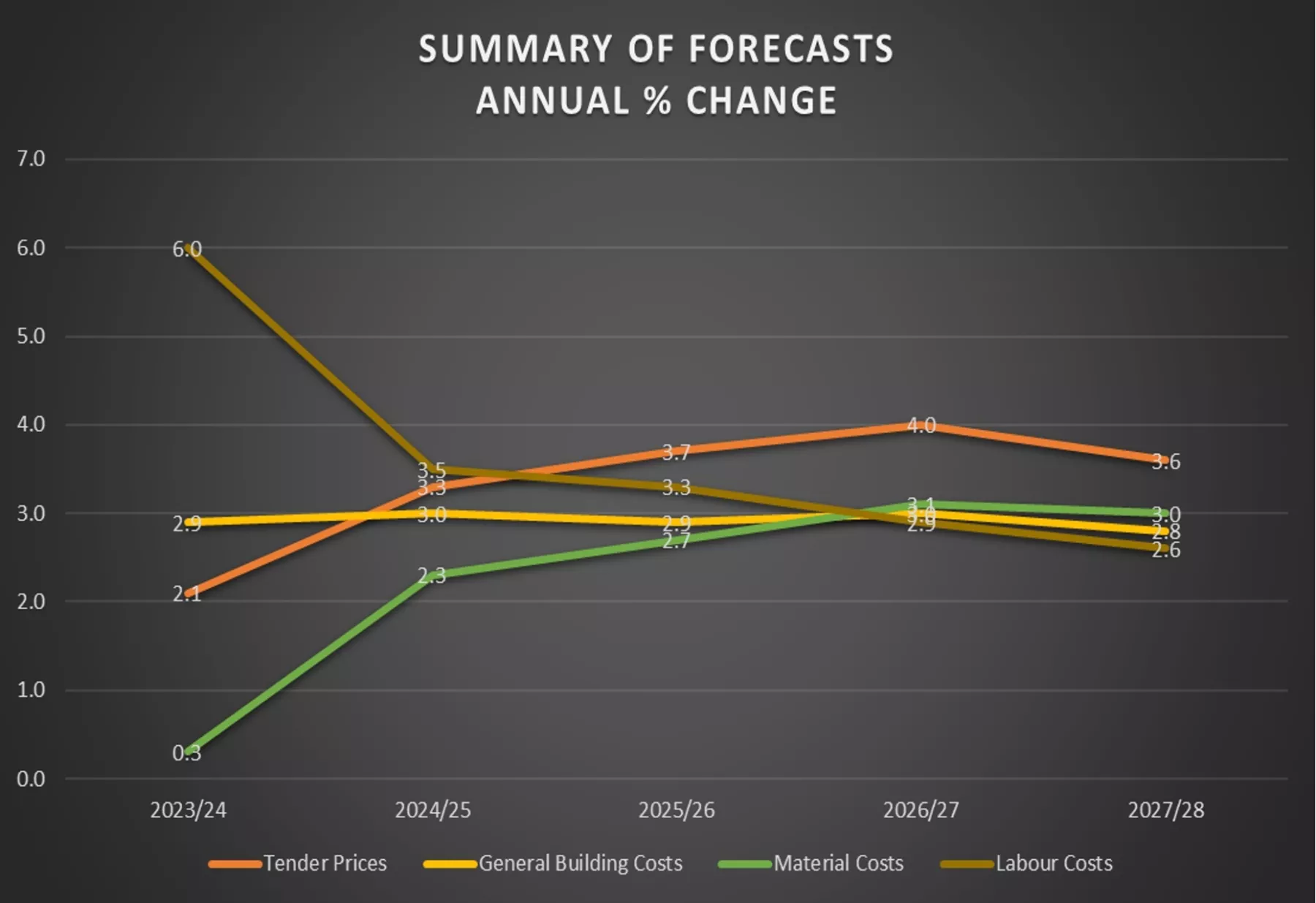

Summary of Forecast

The following forecasts are based on a middle of the road set of assumptions with regards to trade restrictions and economic performance by the UK economy as a whole. However, the figures could vary by up to 15% (+/-) per annum over the period of the forecast.

The forecast movements in construction costs currently shown in the BCIS Quarterly Report are as follows:

Overall, UK Tender prices rose by 0.5% over the last quarter, with a rise of 0.65% identified in Scotland. However, the annual rise dropped by a further 0.2% to 2.1% (3.4% in Scotland) when compared with the same quarter in 2023.

Both the UK and Scottish Tender Price Assessment Panels noted an increased willingness to tender.

Contactors also seem more selective with two stage or target cost projects being more attractive. There is also evidence that Contractors will accept single stage tender invitations but are more likely to drop out when more attractive opportunities appear, often resulting in limited returns.

The level of competitive pricing currently being experienced is likely to continue into 2025 and it is only from then on, that tender prices will rise faster than costs. Over the next five years tender prices are currently forecast to rise by 20% overall, a 2% increase compared to the last forecast.

Building costs rose by 0.7% in the last quarter when compared to the previous quarter and by 3.4% from the same quarter a year ago, an increase from the last forecast but forecast to reduce in 3Q2024 to 2.9% per annum. Building costs are forecast to rise by 17% in total over the next 5 years, an increase of 3% from the previous forecast.

The risk of insolvencies remains high, with over 4,200 companies going out of business in the year to May 2024 and overall levels of insolvency 35.2% higher than pre-pandemic levels.

A recent survey by Begbies Traynor showed construction to have the highest proportion of firms in ‘critical financial distress’, the highest of any industry, but it did note that there were signs of conditions levelling out, with potential reductions possible over the next few years.

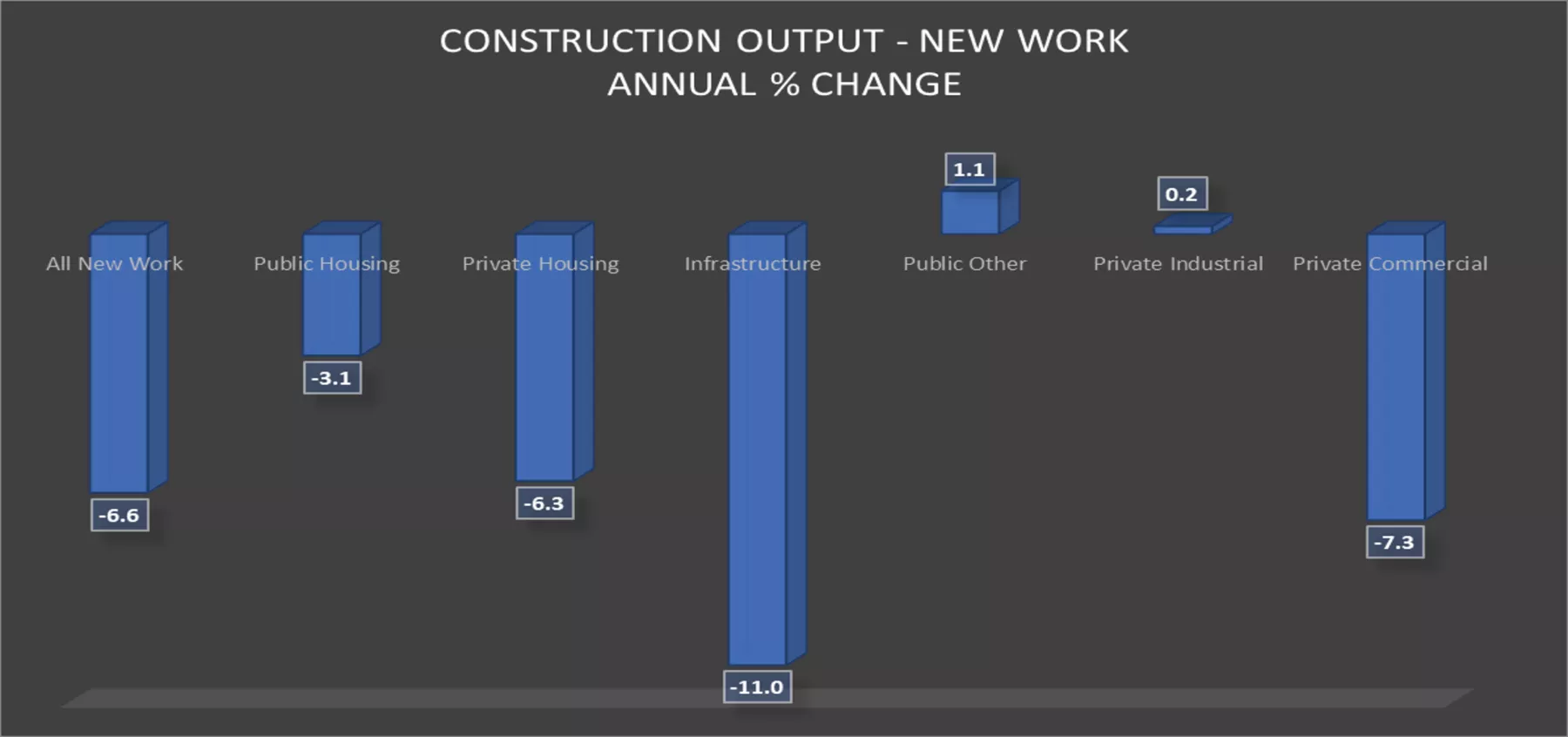

Construction Output

Overall construction output fell by 0.4% in July when compared with the previous month and by 1.6% over the last year. A further reduction of around 5.5% is forecast in 2024. Growth of 1.6% is expected in 2025, with increases of 3% - 6% per annum from 2026 to 2029.

In terms of new work, sector specific decreases of up to 11% were recorded, with the total new work output declining by 6.6% as shown in the graph below.

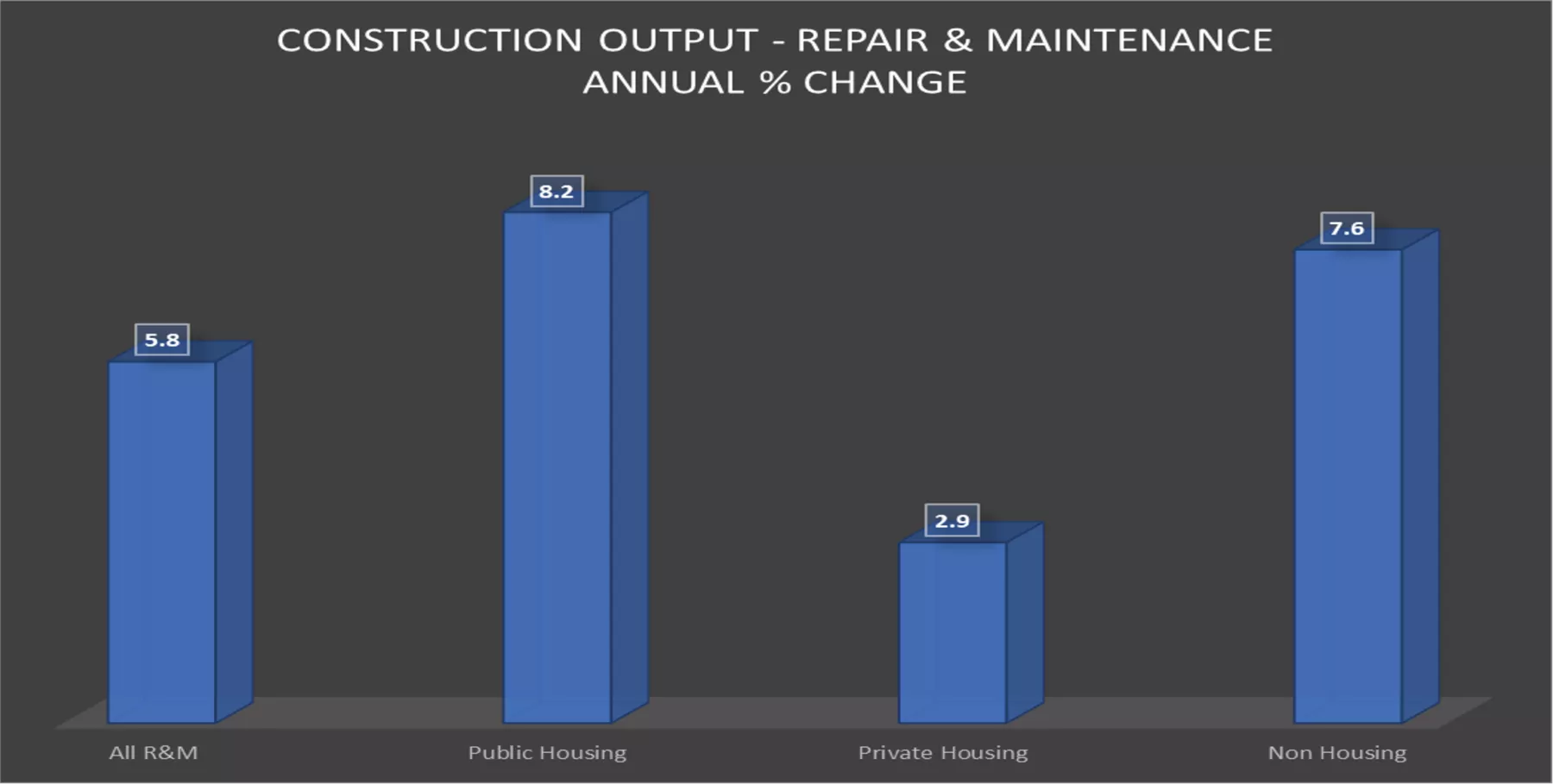

There was however a more positive picture for the Repair and Maintenance sector, with an annual increase of 5.8%, albeit with the rate of growth reducing over the last quarter and a decrease of 0.7% in July. Annual increases ranged from 2.9% - 8.2% as shown in the graph below.

Conclusion

The impact of the forthcoming UK Government Budget on Scotland remains to be seen, but with a government aiming to boost growth hopes of an improving outlook are rising, with planning reforms and housebuilding targets directly providing a boost to the construction sector.

Further interest rate cuts should improve development feasibility and lead to increased confidence in the private sector over the coming year, although reduced supply chain capacity may lead to increased inflationary pressures and hinder workload growth in the longer term.

Sign up for news

Receive email updates from Thomson Gray direct to your inbox:

- Subscribe to Practice News

- Subscribe to Market Outlook