Market Outlook January 2025

The outlook for the economy as a whole remains depressed for the next couple of years, with nominal overall growth in GDP forecast.

The latest GDP figures, which showed a nominal increase following no growth over the last two months, reflect the general economic sentiment. The growth seen in the first half of the year has slowed with consumer and business confidence waning in response to continuing price rises.

Whilst there is now a greater degree of political certainty following the recent General Election, there appears to be little substance behind the new Government’s ‘Get Britain Building’ policy with public sector spending, particularly on large construction projects, likely to be severely restricted in the upcoming spending review given budgetary pressures generally.

The increases in Employer’s National Insurance announced in the Autumn Budget are unlikely to be absorbed and will lead to increased tenders going into 2025, with projects currently on-site and continuing past April 2025 looking to use contractual means to recover the additional costs.

The increase in minimum wage will only have a nominal impact on the construction sector as the majority of labour is already paid above the new base level, but there will be a ripple effect as higher skilled levels seek to maintain their wage differential.

There remains a reasonable amount of positivity in the Construction sector, as evidenced by recent UK Construction Purchasing Managers’ Index surveys (a general indicator of construction industry sentiment) being positive for the last nine months, although to a lesser degree than back in September, output in 2024 is still expected to fall with a gradual recovery expected from mid-2025 onwards.

The recent small decrease in inflation (CPI) to 2.5% in December may prompt a further 0.25% reduction in Base Rate by the Bank of England in February as this is seen as a useful tool to stimulate the economy in the first quarter of the year. Although the bank may adopt a more cautious approach as inflation remains above the often stated 2% target.

Local Outlook

Looking at Scotland in general, the construction sector continues to suffer from lower demand, however, the view on anticipated pipelines of projects going to tender over the next 12 months has improved over the last quarter with more companies forecasting an increase in opportunities or unchanged position rather than reductions as was seen last quarter.

However, Contractors have raised concerns about the lack of information on forthcoming projects with public sector organisations not listing projects online and Consultants not having the long-term view of a few years ago.

Contractors’ interest in tendering for projects remains generally positive, albeit with established Tier 1 Contractors being more selective. There is also more evidence of a shift in attitude to smaller (sub £5m) projects with Contractors regularly operating at that level actively seeking opportunities, with not many planning to move into the ‘Tier 1’ market following the ISG collapse.

Lack of capacity in the supply chain continues to cause concern, with an ageing workforce, and issues with apprenticeship recruitment, particularly prevalent in the northern regions and islands where a lack of contractors is leading to reduced levels of competition and subsequently higher prices than experienced in the central belt.

Delays in the planning process was also highlighted as a current issue with numerous projects, including several large student accommodation developments facing lengthy delays in progressing to the market and onto construction.

Both the BCIS Consultants and Contractors panels reported that risk sharing on projects is rare, with fixed price contracts still in widespread use, and risk generally sitting with the Contractor. Early development of robust programmes and project risk registers are seen as at least a partial solution to allow risk holders to understand the potential cost implications.

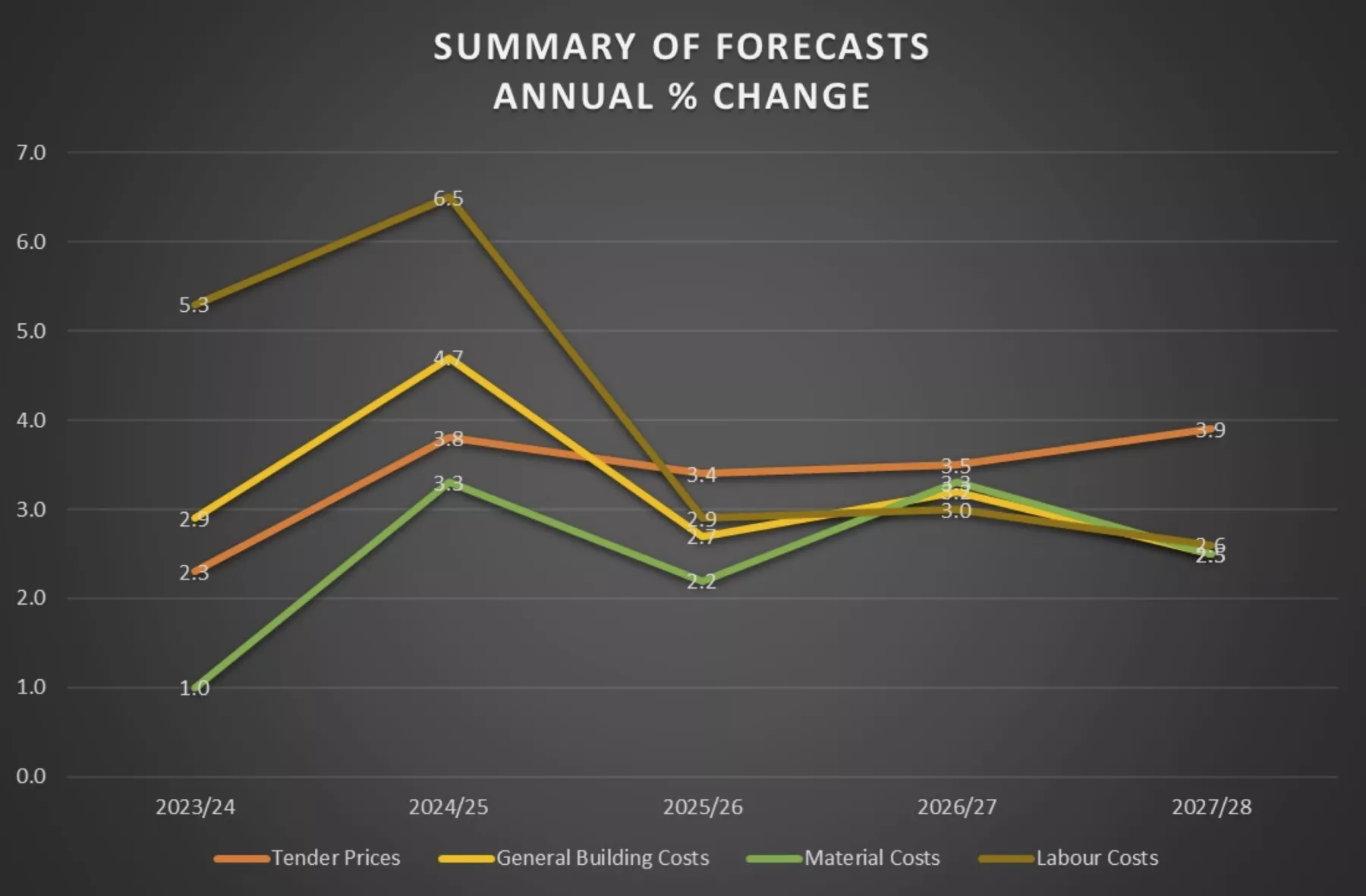

Summary of Forecast

The following forecasts are based on a middle of the road set of assumptions with regards to trade restrictions and economic performance by the UK economy as a whole. However, the figures could vary by up to 15% (+/-) per annum over the period of the forecast.

The forecast movements in construction costs currently shown in the BCIS Quarterly Report are as follows:

Overall, UK Tender prices rose by 0.8% over the last quarter, with a rise of 0.6% identified in Scotland. However, the annual rise increased by 0.2% back to 2.1% (3.3% in Scotland) when compared with the same quarter in 2023. Both the UK and Scottish Tender Price Assessment Panels noted an increased willingness to tender, particularly on smaller projects. Tier 1 Contactors with healthy pipelines are generally being more selective with procurement route and risk profiles the main considerations.

The level of competitive pricing currently being experienced is still likely to continue well into 2025 and it is only from then on, that tender prices will rise faster than costs. Over the next five years tender prices are currently forecast to rise by 18% overall, a 2% decrease compared to the last forecast, but still at a higher rate than building costs.

Building costs rose by 1.3% in the last quarter when compared to the previous quarter and by 2.9% from the same quarter a year ago, a decrease from the 3.4% reported in the last forecast but reducing as expected with no change anticipated in 4Q2024. Building costs are forecast to rise by 15% in total over the next 5 years, a reduction of 2% from the previous forecast. Building cost inflation is currently being driven by labour costs with this trend forecast to continue.

There is a widespread view that the industry has not felt the worst effects of the ISG collapse with the supply chain likely to reduce further, particularly on key specialist trades through further insolvencies, putting more pressure on the remaining companies to provide tender process and deliver projects on site.

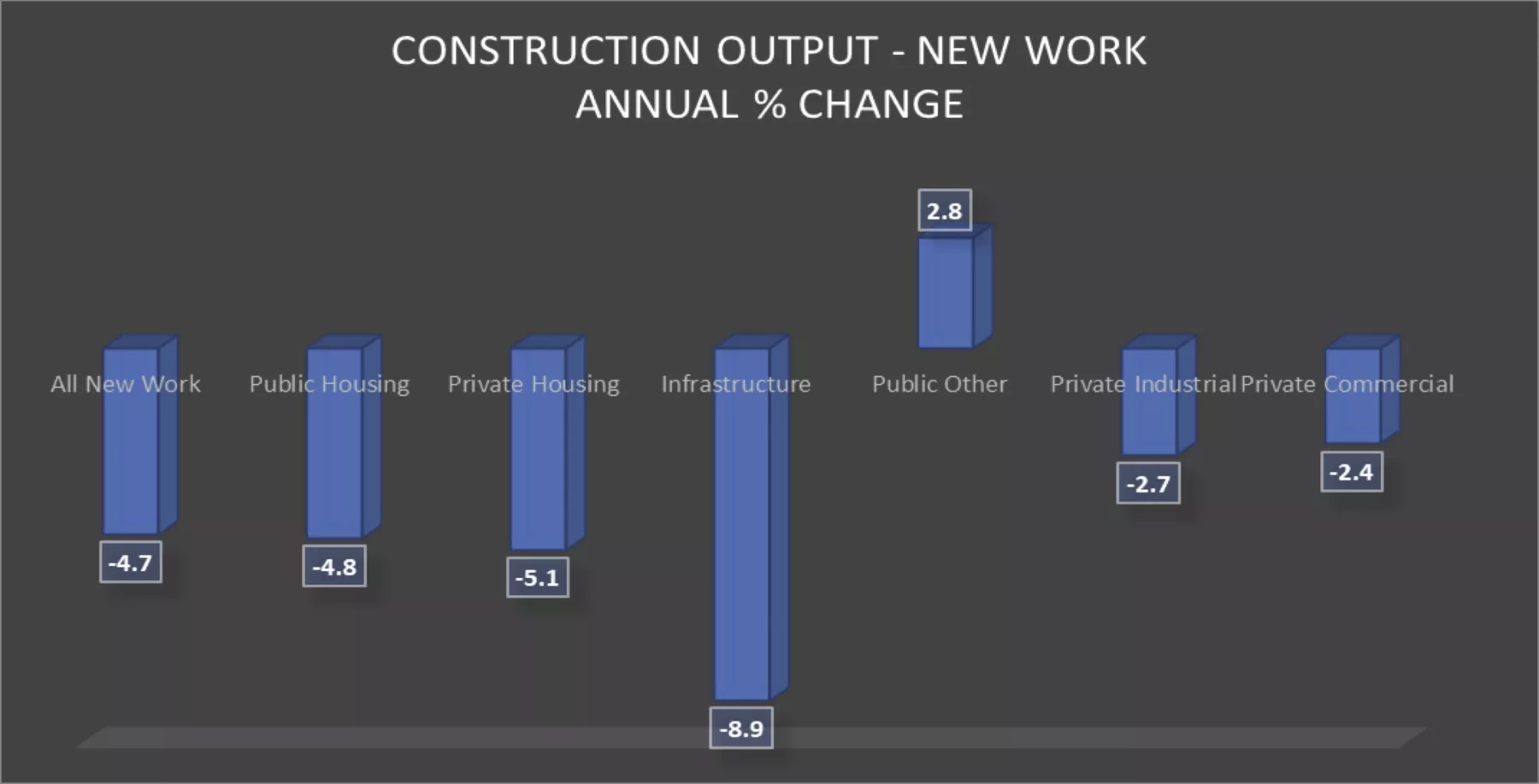

Construction Output

Overall construction output rose by 0.1% in September when compared with the previous month but fell by 0.4% over the last year. Growth of 1.5% is expected in 2025, with increases of 3% - 6% per annum from 2026 to 2029

In terms of new work, sector specific decreases of up to 9% were recorded, with the total new work output declining by 4.7% as shown in the graph below.

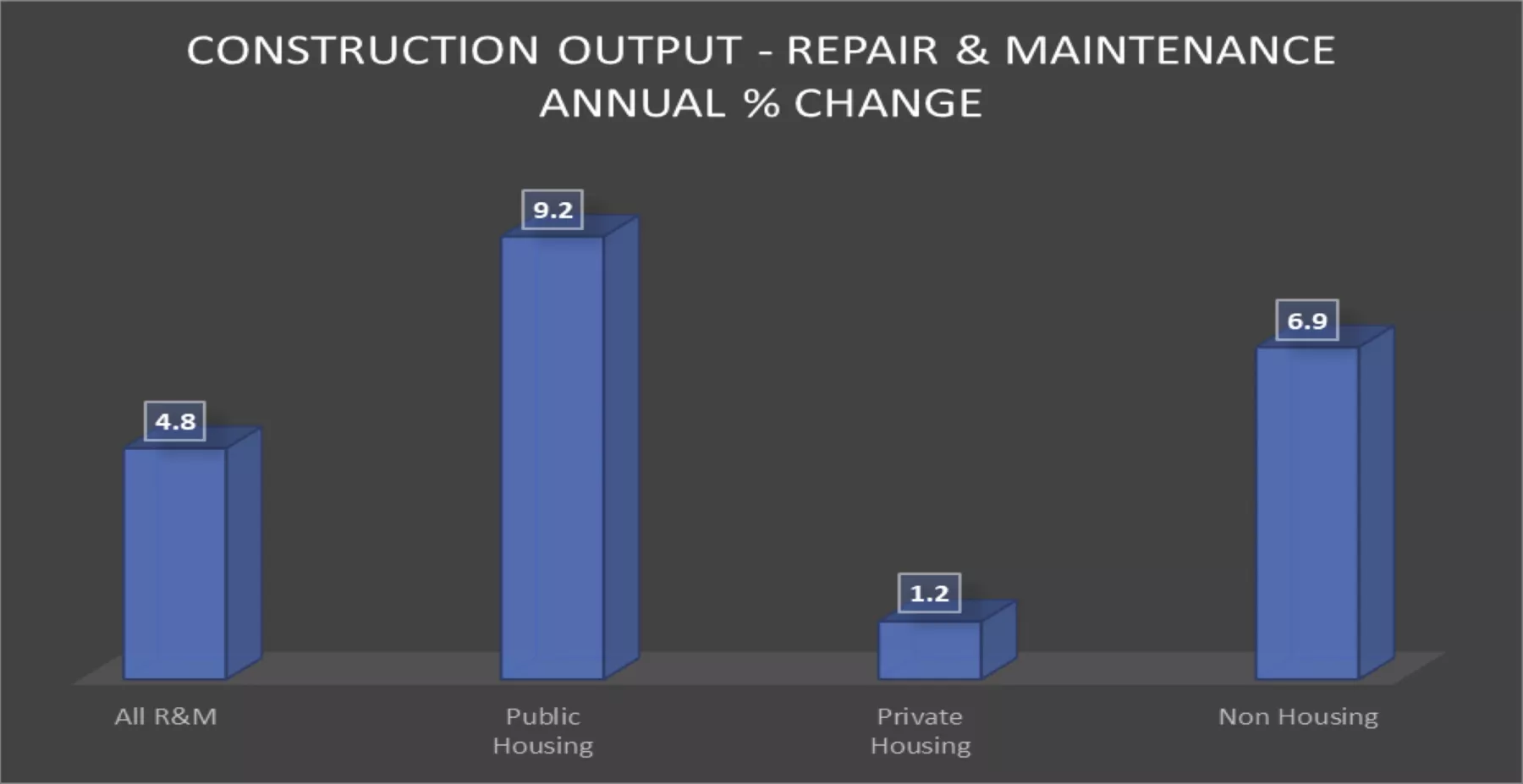

There was however a slightly better picture for the Repair and Maintenance sector, with an annual increase of 2.8%, albeit with the rate of growth reducing again over the last quarter and an increase of only 0.4% in September. Annual increases ranged from 0.3% - 12.1% as shown in the graph below.

Conclusion

While there is a view that the economic situation generally has deteriorated rapidly since the general election – with government borrowing at exceptionally high rates, inflation remaining well above the target and new work output falling in 2024 – the market remains positive for the construction sector in 2025 with the Market Conditions Index continuing to rise in the last two quarters of 2024.

Whether this optimism will continue through 2025 is very much dependent on the spring spending review for public sector spending and potential interest rate reductions stimulating private sector investment, particularly in housing and infrastructure projects.

Sign up for news

Receive email updates from Thomson Gray direct to your inbox:

- Subscribe to Practice News

- Subscribe to Market Outlook